PCV Valve Vs Breather Filter: a Replacement Guide

Imagine your vehicle's engine as a finely tuned orchestra, with each component playing an important role in the symphony of performance. Now, picture the PCV valve and breather filter as silent conductors, ensuring harmony within this mechanical ensemble.

While both may go unnoticed, their maintenance is essential for your engine's health. Discover the silent troublemakers lurking within your vehicle's system and uncover the key to keeping your engine running smoothly and efficiently.

Key Takeaways

- PCV Valve controls emissions and maintains engine efficiency, breather filter filters contaminants for engine longevity.

- Regular replacement of PCV Valve and breather filter is crucial for optimal engine performance.

- Symptoms of PCV Valve issues include increased oil consumption, while breather filter issues result in decreased engine power.

- Follow precise steps to replace PCV Valve and potentially the breather filter for smooth engine operation.

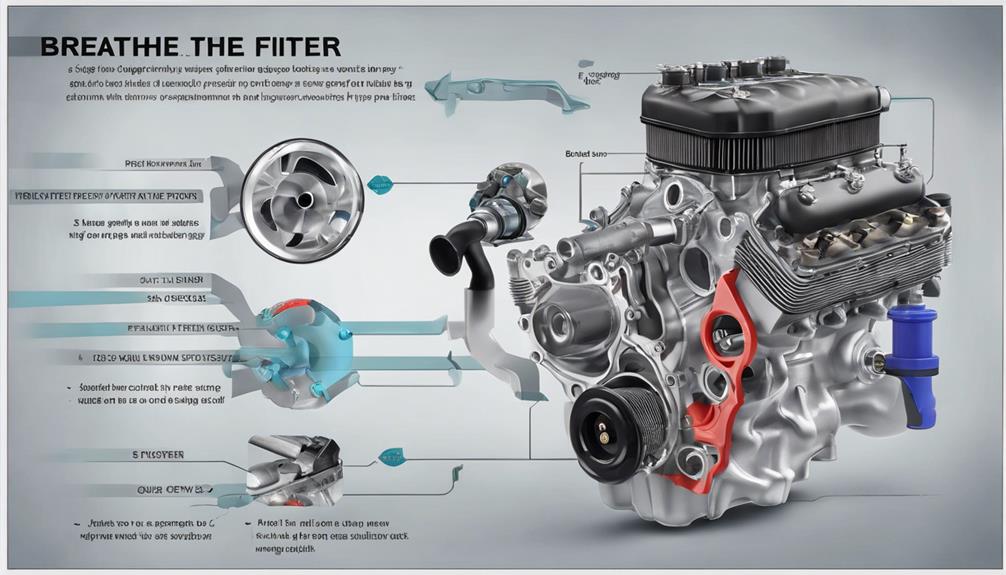

PCV Valve Function

To understand the PCV valve function, you must grasp its critical role in controlling the emissions system of your vehicle. The Positive Crankcase Ventilation (PCV) valve plays an essential part in maintaining engine efficiency and reducing harmful emissions. This small but vital component is responsible for regulating the flow of gases between the crankcase and the intake manifold.

Proper PCV valve maintenance is vital to make sure that your vehicle operates at peak performance levels. Over time, the PCV valve can become clogged or malfunction, leading to a variety of issues such as decreased fuel efficiency and increased emissions. Regular inspection and replacement of the PCV valve are key aspects of vehicle maintenance that shouldn't be overlooked.

In addition to its role in emissions control, the PCV valve also helps in preventing the buildup of pressure within the engine. This, in turn, helps to extend the life of engine components and improve overall engine performance. By understanding the importance of PCV valve maintenance and its impact on your vehicle's emissions system, you can make sure that your vehicle operates efficiently and remains environmentally friendly.

Breather Filter Purpose

The breather filter serves to capture and filter out harmful contaminants from the air entering the engine. By trapping particles like dirt, debris, and oil mist, the breather filter prevents these substances from reaching key engine components, thus maintaining peak performance. One of the key benefits of the breather filter is its ability to enhance engine longevity by reducing wear and tear caused by these contaminants. Additionally, the filter helps maintain proper air-to-fuel ratios, guaranteeing efficient combustion within the engine.

To make sure the breather filter functions effectively, regular maintenance is essential. Periodically inspect the filter for any signs of clogging or damage, and replace it as needed to prevent restricted airflow. It's advisable to follow the manufacturer's guidelines regarding filter replacement intervals. Keeping the breather filter clean and in good condition will contribute to the overall health and efficiency of your engine, ultimately prolonging its lifespan and preventing potential issues down the road.

Signs of PCV Valve Failure

Inspecting your engine for signs of PCV valve failure is important for maintaining top performance and preventing potential issues. Here are some indications that your PCV valve may need replacement:

- Increased Oil Consumption: If you notice that your vehicle is burning more oil than usual, it could be a sign that the PCV valve is failing and not effectively recycling oil vapors back into the engine.

- Check Engine Light: A failing PCV valve can trigger the check engine light on your dashboard. Have your vehicle scanned for error codes to see if the PCV valve is the culprit.

- Poor Engine Performance: A faulty PCV valve can lead to a decrease in engine performance, such as rough idling, stalling, or a decrease in fuel efficiency. If you experience any of these issues, it may be time for a PCV valve replacement.

Regular PCV valve replacement and breather filter maintenance are essential for keeping your engine running smoothly and efficiently.

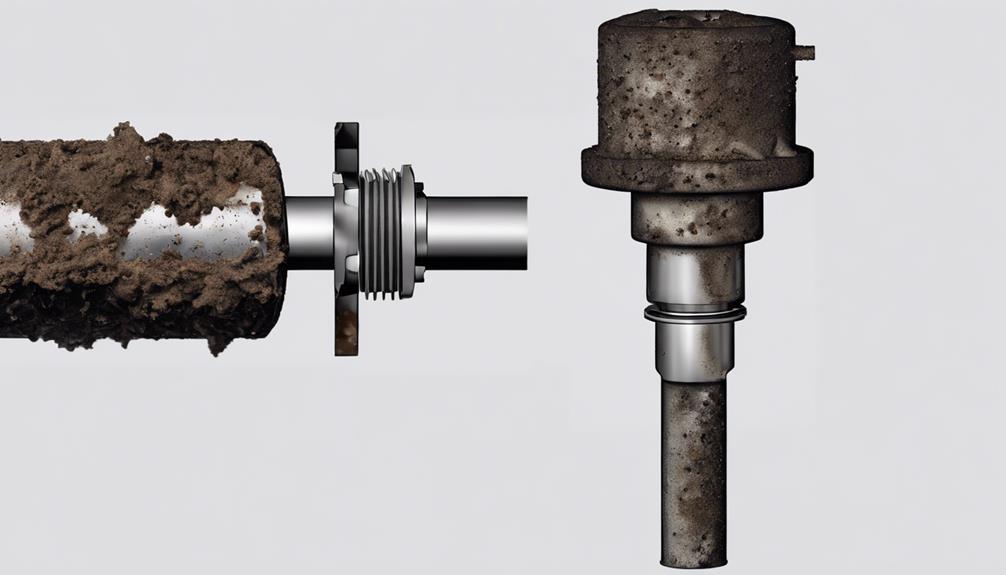

Symptoms of Clogged Breather Filter

Examine the breather filter for symptoms of clogging to guarantee peak engine performance and efficiency. A clogged breather filter can manifest in various ways, impacting your engine's overall functionality. One prominent symptom is a decrease in engine performance, often leading to reduced power output and acceleration. This decline occurs because a clogged breather filter restricts the airflow necessary for best combustion within the engine cylinders.

Additionally, you may notice a decrease in fuel efficiency as the engine compensates for the lack of proper air filtration by consuming more fuel than usual. Another sign of a clogged breather filter is an increase in engine noise, caused by the strain on the engine due to restricted airflow. Regularly checking and replacing the breather filter is vital to prevent these issues and assure your engine operates at its best capacity.

Proper air filtration is essential for maintaining engine health and performance, so be vigilant for these symptoms to address any potential clogs promptly.

Steps to Replace PCV Valve and Breather Filter

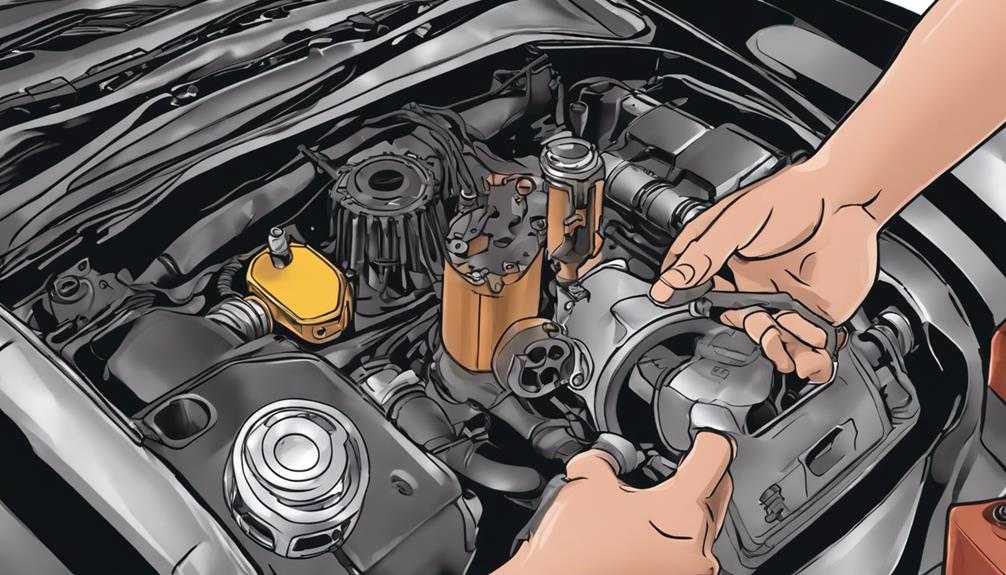

To guarantee peak performance of your vehicle's engine, the replacement process for the PCV valve and breather filter involves several precise steps.

When replacing the PCV valve and maintaining the breather filter, follow these steps:

- Locate the PCV Valve: Find the PCV valve on the engine. It's typically located on the valve cover or the intake manifold.

- Remove the Old PCV Valve: Carefully disconnect the hose clamps and remove the old PCV valve from its mounting location.

- Install the New PCV Valve: Attach the new PCV valve securely in place and reconnect the hose clamps to ensure a tight seal.

Remember to also check and potentially replace the breather filter during this process to maintain proper airflow and prevent contaminants from entering the engine.

Frequently Asked Questions

Can Using Aftermarket PCV Valves or Breather Filters Void My Vehicle's Warranty?

Using aftermarket parts like PCV valves or breather filters might void your vehicle's warranty. Manufacturers often require original components for warranty coverage. Check your warranty terms to avoid any issues. Stick to approved parts.

Is It Necessary to Replace Both the PCV Valve and Breather Filter at the Same Time, or Can They Be Replaced Separately?

Like a well-oiled machine, consider replacing both the PCV valve and breather filter at recommended intervals to guarantee compatibility and peak engine performance. DIY installation is feasible, but professional help guarantees precision.

How Often Should the PCV Valve and Breather Filter Be Replaced for Optimal Engine Performance?

To maintain peak engine performance, replace the PCV valve and breather filter according to your maintenance schedule. Regular replacements prevent problems and enhance performance. DIY tips can help troubleshoot and guarantee your engine runs smoothly.

Are There Any Special Tools or Equipment Required to Replace the PCV Valve or Breather Filter?

You don't need special tools for replacing the PCV valve or breather filter. Both tasks can be done DIY with basic equipment. Professional replacement might guarantee precision, but with the right guidance, you can handle it yourself.

What Are Some Common Misconceptions About PCV Valves and Breather Filters That Car Owners Should Be Aware Of?

Common misconceptions about PCV valves and breather filters include thinking they don't need maintenance. Neglecting them can lead to engine issues. Regularly check and replace these parts to guarantee proper functioning of your vehicle.

Conclusion

To sum up, when it comes to maintaining your vehicle's engine health, ensuring the proper functioning of the PCV valve and breather filter is essential. By recognizing the signs of failure and taking proactive steps to replace these components, you can prevent costly repairs down the road.

Remember, regular maintenance is key to keeping your engine running smoothly and efficiently. Don't delay – explore the details and drive with confidence!